- GRANDPA GOT HACKED

- Posts

- Experian Edition: Social Security Tools (Free)

Experian Edition: Social Security Tools (Free)

Step-by-Step Guide to Placing a Credit Freeze, Monitoring Your Credit, and Tracking Identity Exposure with Experian

👀 Today’s Focus: In our last newsletter, Social Security Data Breaches: What You Need to Know, we explored the risks of exposed Social Security numbers and shared steps to safeguard your SSN.

This time, we’ll take a closer look at how you can take advantage of free tools offered by the credit bureau, Experian. Although Experian provides several free services, today we’ll focus on three key tools: placing a credit freeze, regularly monitoring your credit, and keeping track of your identity exposure.

😎 Grandkid Tip of the Day: Step-by-Step Guide to Setting Up an Experian Account, Placing a Credit Freeze, Monitoring Your Credit, and Tracking Identity Exposure.

Step 1: Setting an Experian Account

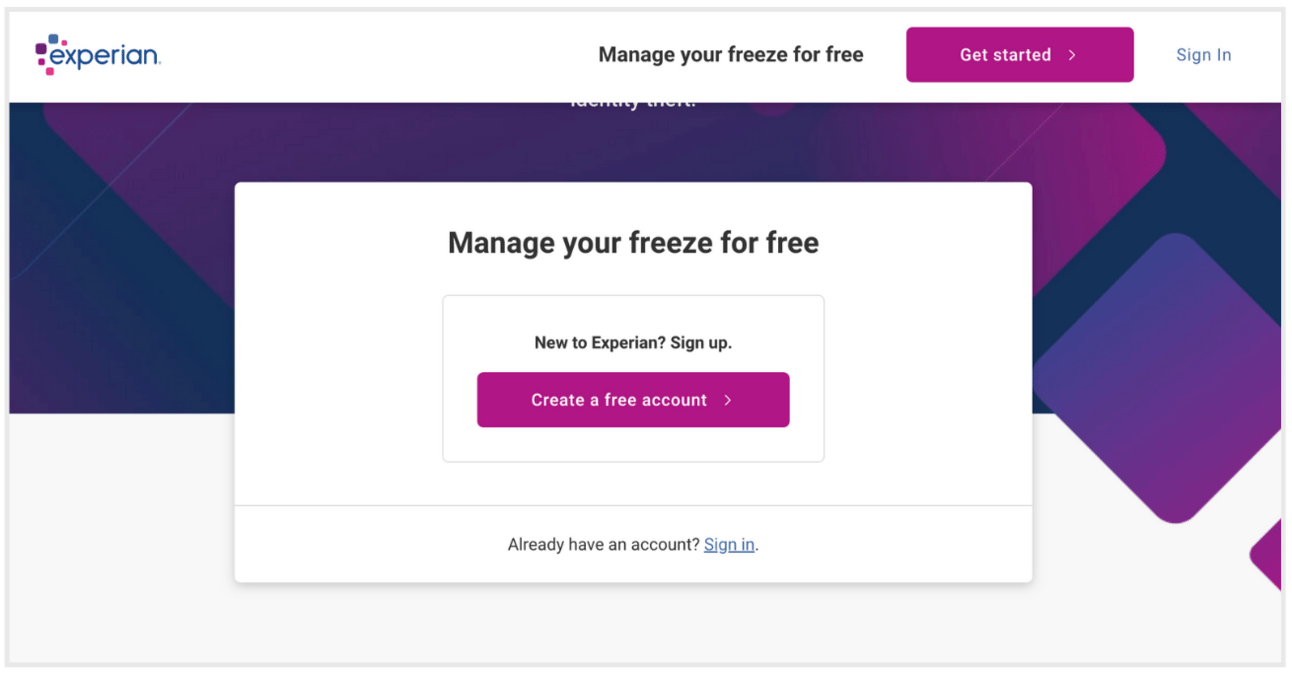

On a computer, navigate to https://www.experian.com/freeze/center.html and select “Create a free account”.

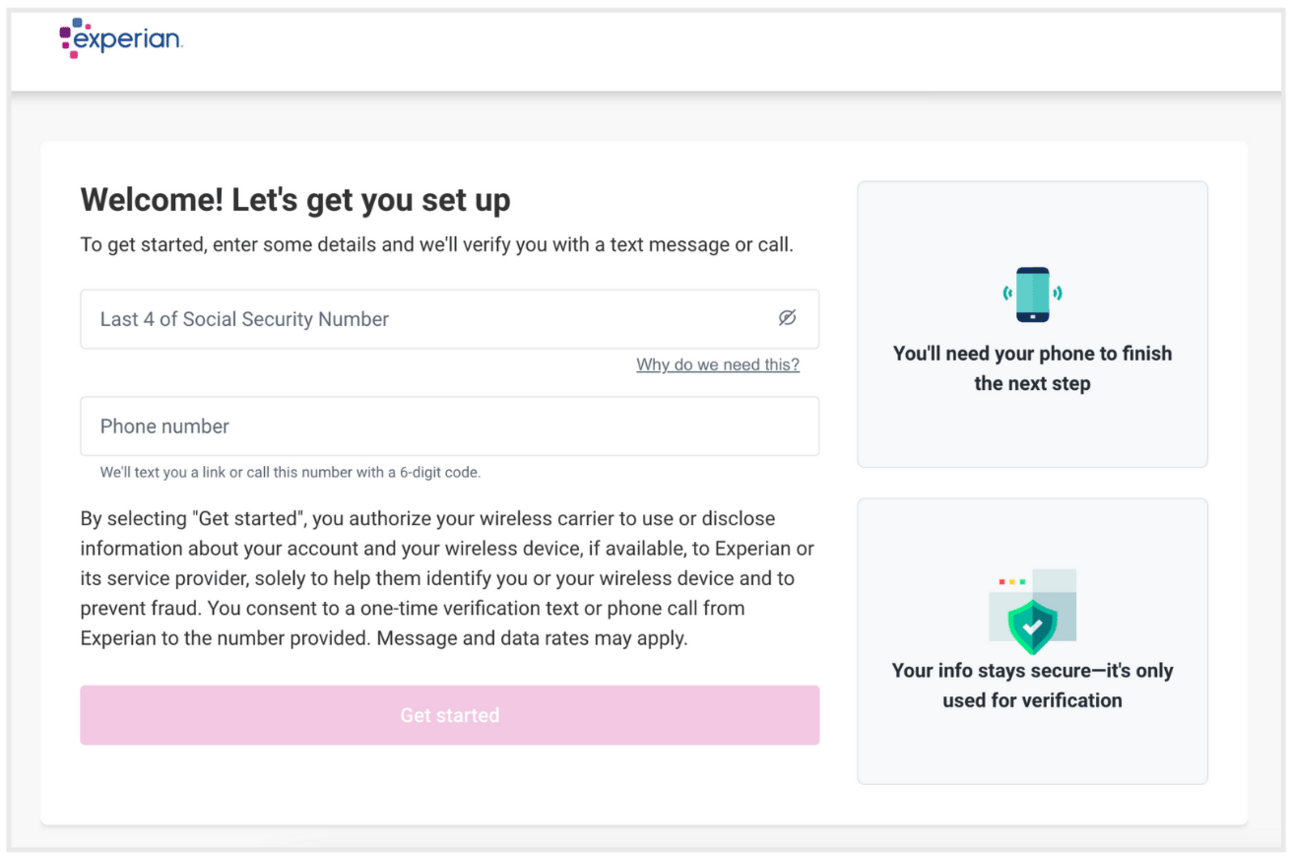

On the next screen, enter the last four digits of your SSN, your phone number and click “Get started”. Experian will use this information to pull the data on file and verify your phone number.

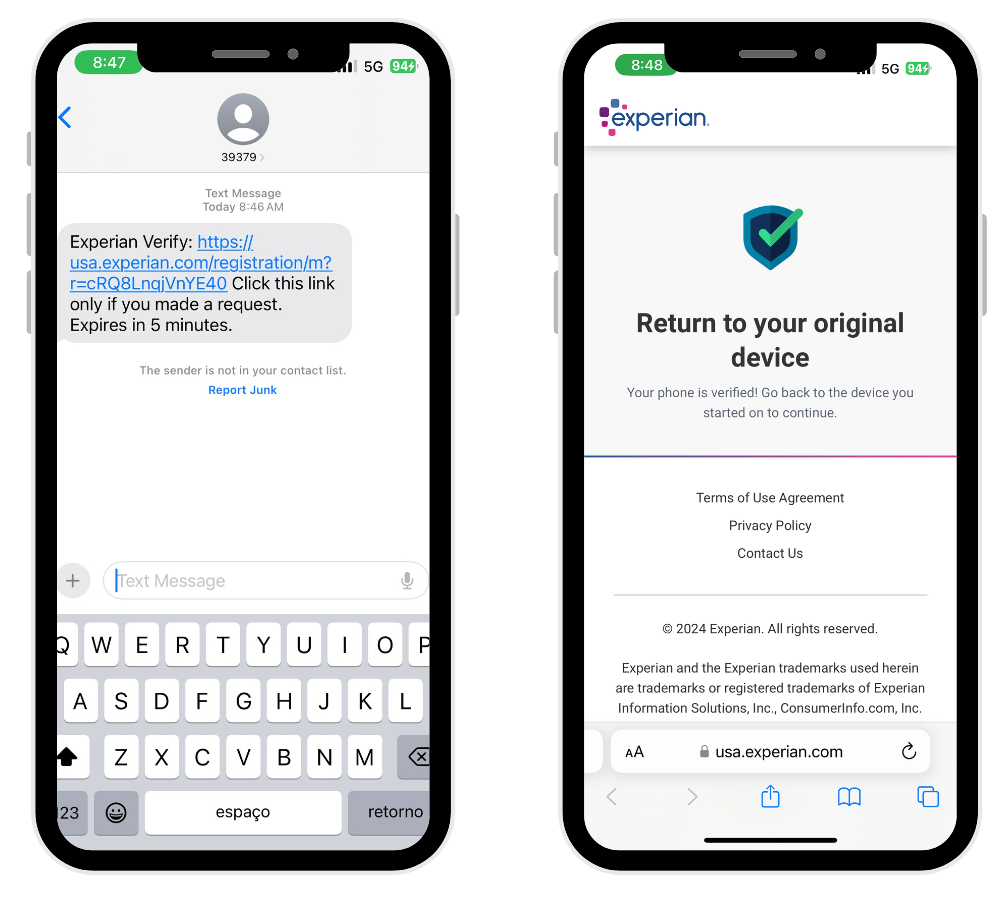

Once you enter the information above, you will receive a text. Click the link, which will trigger Experian to verify your phone number. Once this has been properly verified, you will receive the confirmation below to “Return to your original device”

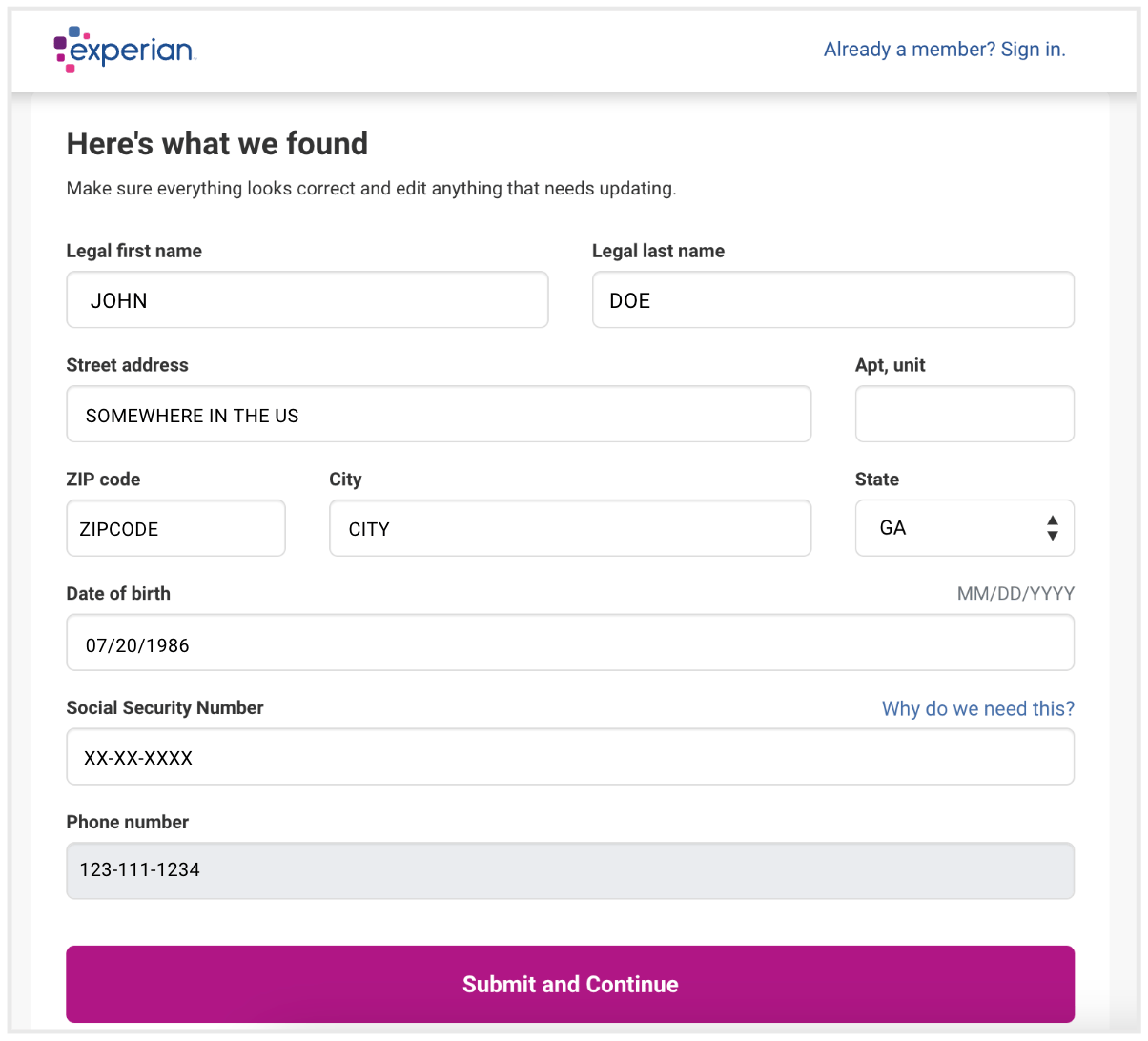

The screen on your computer will update to display your information on file. Please review it to ensure it is up to date before clicking on “Submit and Continue”.

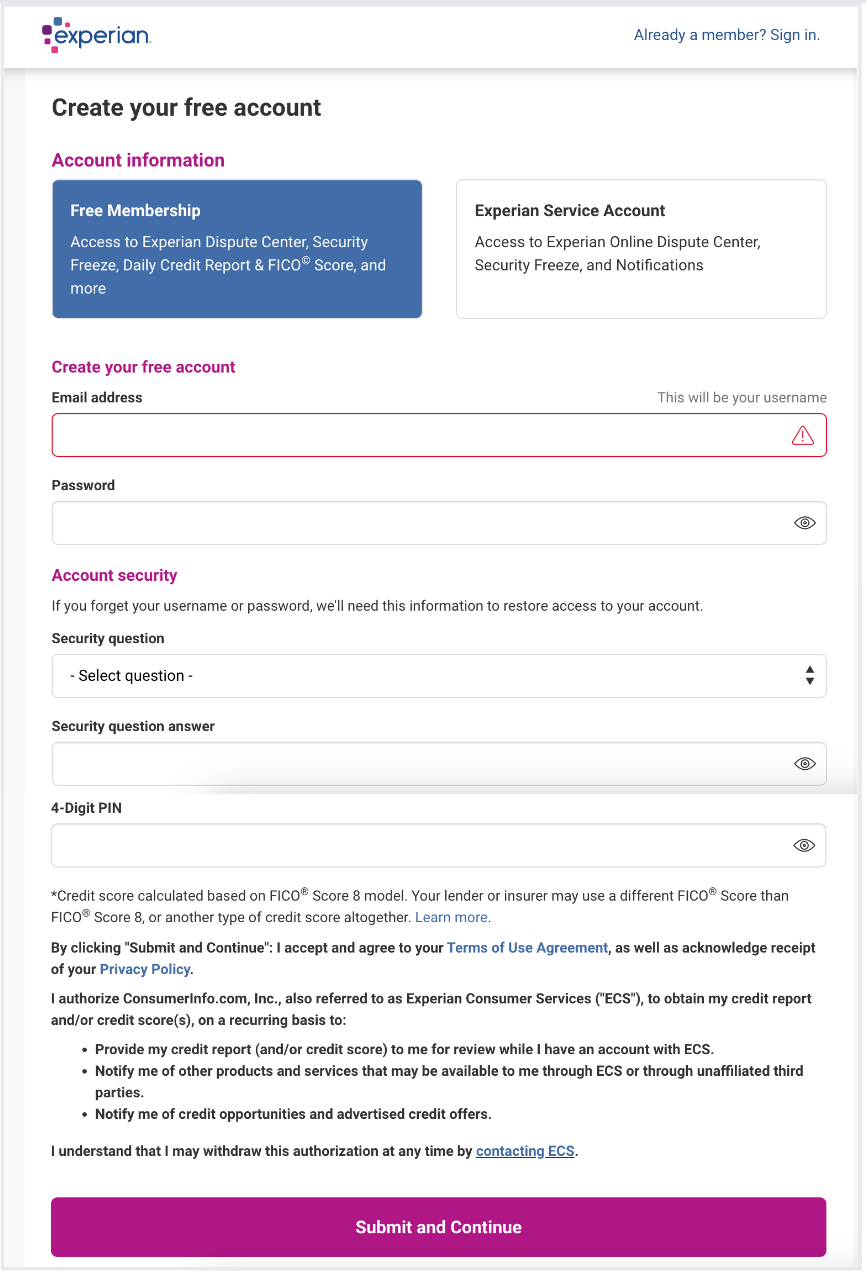

Fill out your login information to create an account and ensure that you select “Free Membership”. Don’t forget to set up a complex passphrase for your password.

👀 Don't forget to set up two-factor authentication in the Account Settings later, to add an extra layer of security when logging into your Experian account.

Step 2 (A): Placing a Credit Freeze

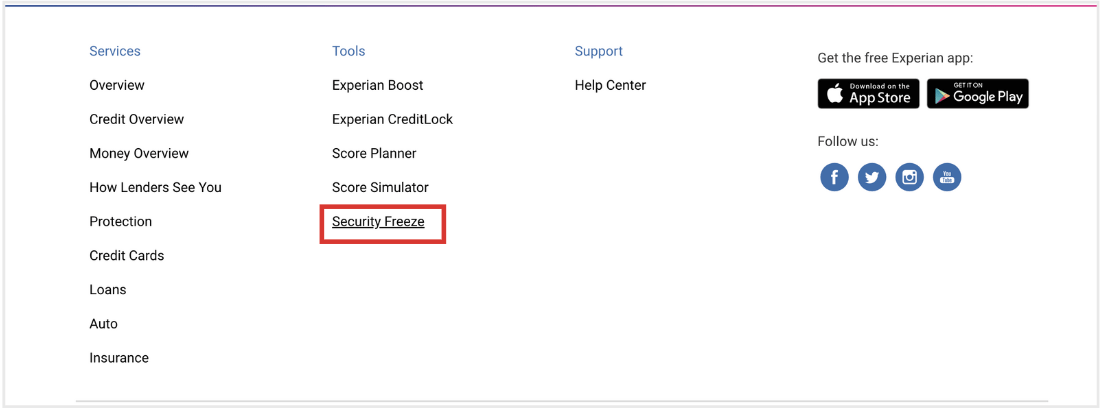

After setting up and logging into your Experian account, navigate to the Security Freeze section.

The Security Freeze section can be found at the bottom of the page or can be accessed directly here: https://usa.experian.com/mfe/regulatory/security-freeze.

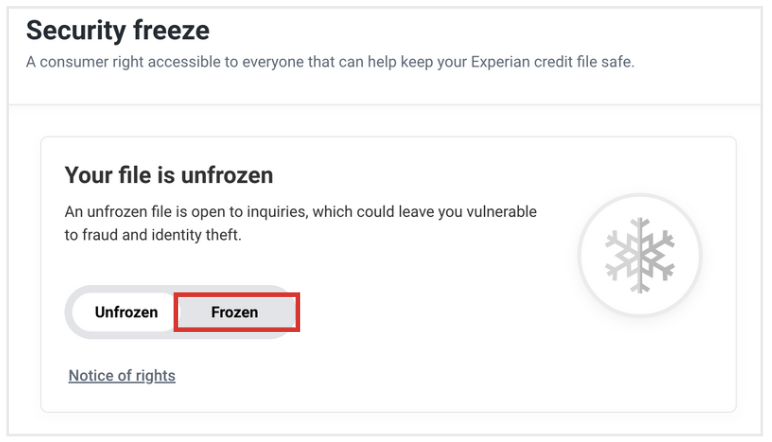

Once you're on the page, simply switch the toggle to "Frozen," as shown below.

Note: Experian will offer an upgrade to Experian CreditLock, a paid feature. Here’s a quick comparison:

Security Freeze: Blocks most creditors from accessing your credit file to prevent fraud. It must be applied individually at all three major bureaus (Experian, Equifax, TransUnion) and lacks monitoring alerts. You'll need to manually unfreeze your credit for lenders, which can delay applications.

Experian CreditLock: Provides similar protection but adds daily monitoring, inquiry alerts, and the convenience of instantly locking or unlocking your Experian file.

Step 2 (B): Removing the Credit Freeze

When applying for credit, you’ll need to manually unfreeze your Experian credit file. Simply visit Experian's Security Freeze page and toggle the setting to "Unfrozen".

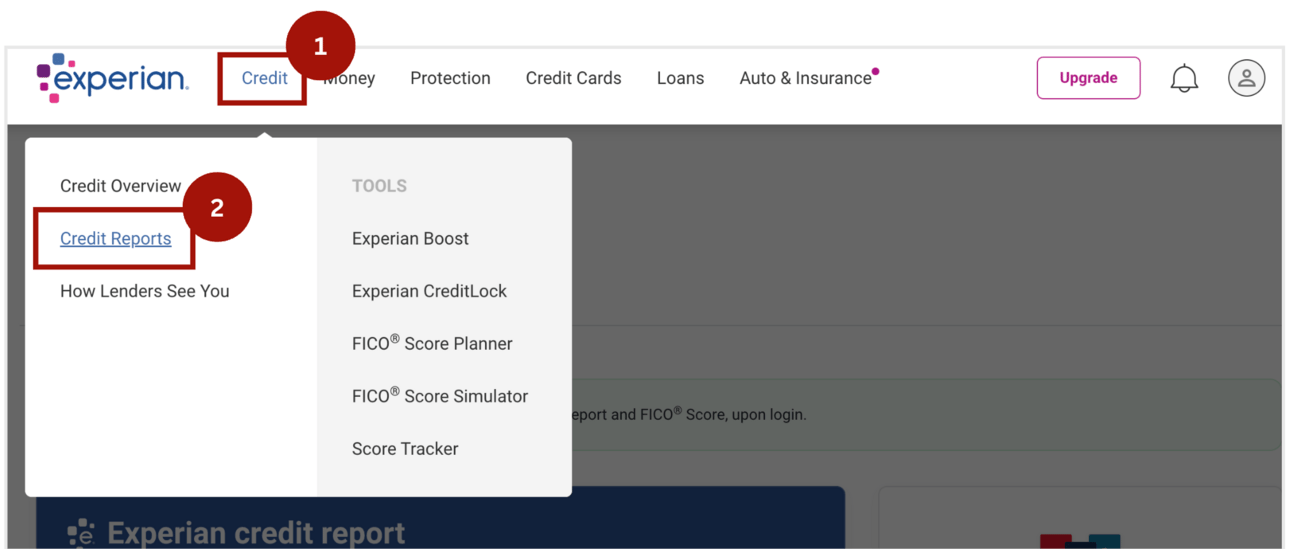

Step 3: Monitoring Your Credit

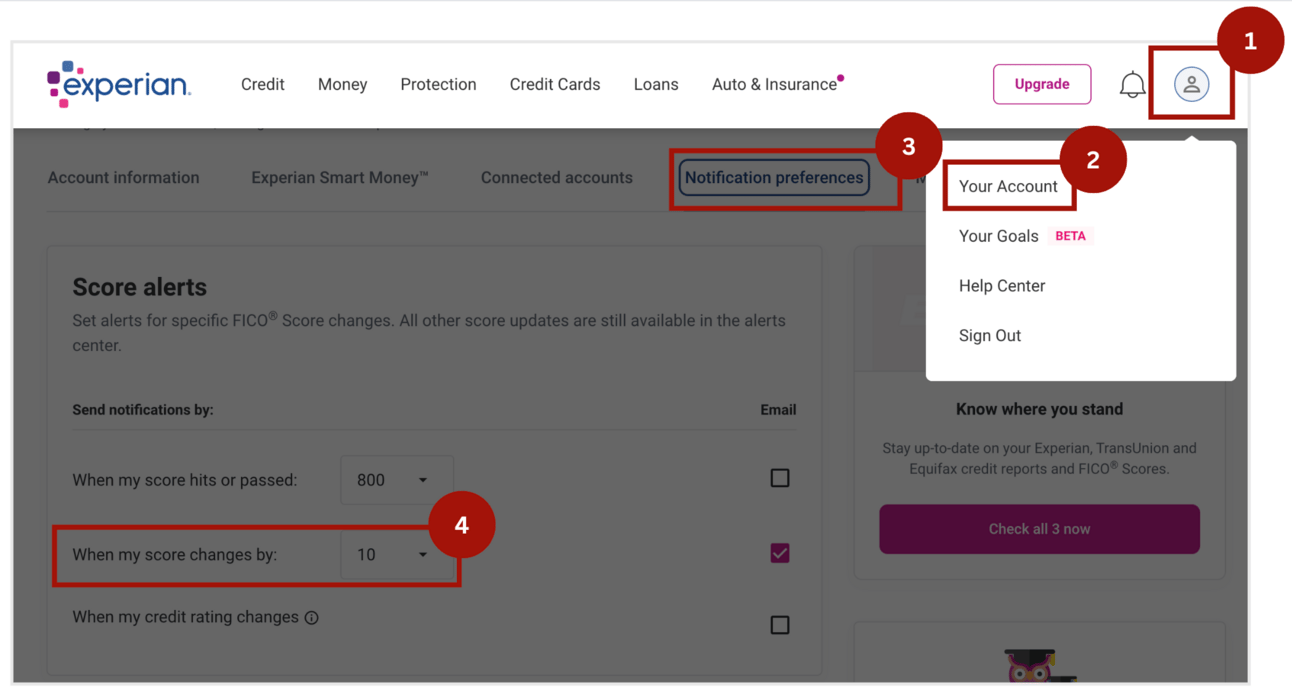

Set up notifications for any changes to your score by a specific percentage under Notification Preferences in Your Account.

Regularly check your credit report to monitor your score and the number of accounts you have open.

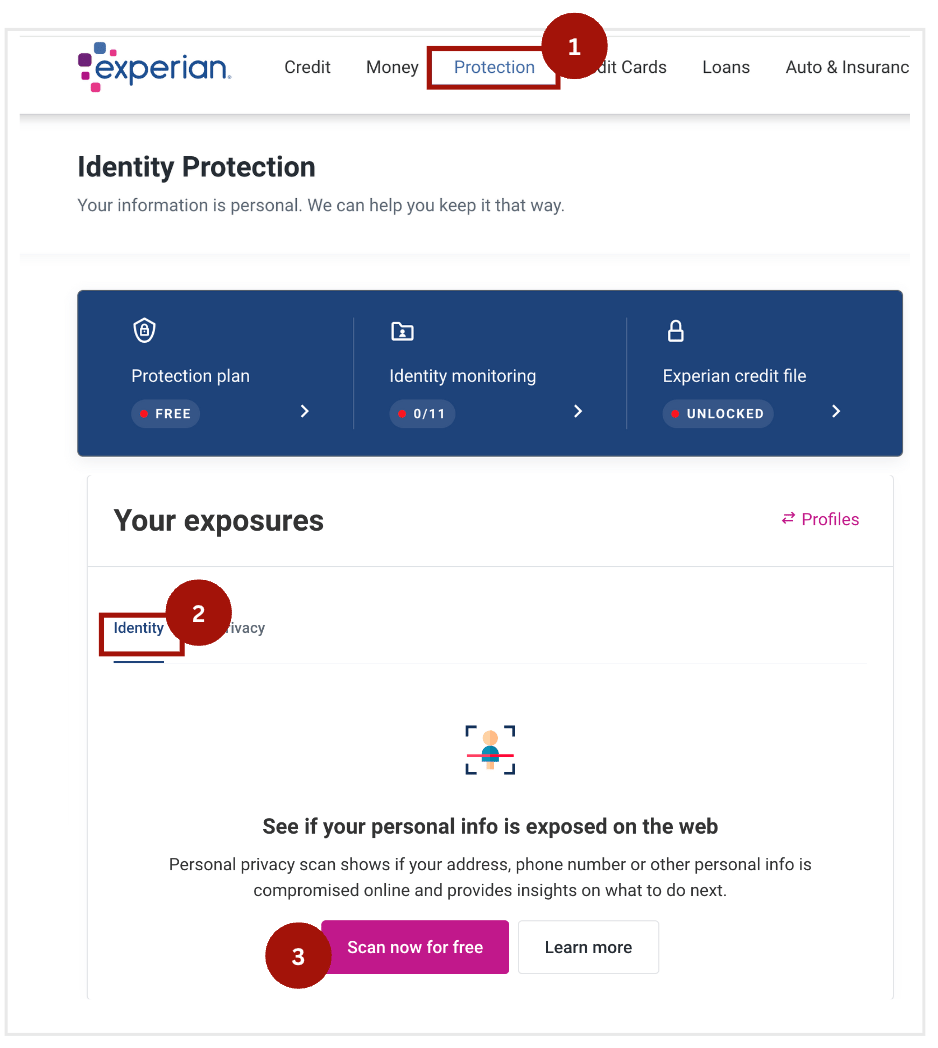

Step 4: Tracking Identity Exposure

Under Protection, you can scan for any personal data that may have been exposed on the dark web.

In our next issue, we’ll explore the free tools offered by Equifax. Keep in mind, to ensure full protection, it's important to utilize these resources across all major credit bureaus —Experian, TransUnion and Equifax.

⭐ Share a story by replying to this email! - If you or someone you know has been hacked or compromised, share your story! We are always looking to raise awareness within our community!

🚀 Sponsor a Newsletter! Do you want to sponsor a newsletter? Reply to this email to contact us.

Got this email forwarded? Subscribe below.